Stock

Stock Donations

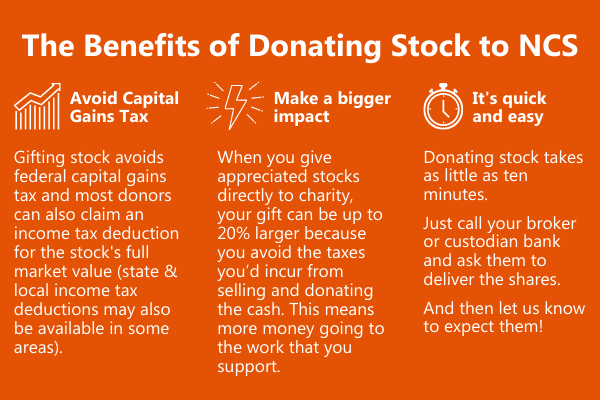

If you have held a security for longer than a year, your gift qualifies as a charitable deduction. Contributing stock is one of the few ways a donor can avoid significant capital gains tax.

Most stock gifts can be delivered to our brokerage account through DTC. If you are uncertain whether your gift is eligible for DTC, please contact your broker or custodian bank.

Step 1: Ask your broker or custodian bank to deliver the shares to:

State Street, DTC #2319

Account Number: HN1078

Account Name: NBTL/FNZ Trust Company Neighborhood Coalition for Shelter, Inc. HN1078

Step 2: Notify us of the details of your gift:

• Name of the security and number of shares

• Name of the broker or bank and contact person at the institution

DTC identifies only the sending institution. We have no way of matching you with your gift unless you notify us.

Contact: Rebecca Kabat, Development and Communications Officer— 212-537-5142